The big increase in private pension coverage is very welcome, but we need to improve the adequacy of pensions and the quality of provision as well.

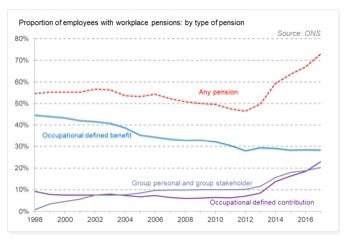

The impact of auto-enrolment on pension coverage has been very significant. As the Resolution Foundation chart below shows, overall workplace pension coverage has jumped from 46.5% in 2012 to 72.9% in 2017.

This chart also shows that the proportion of employees holding defined benefit pensions has continued its longer-term decline. However, this form of quality provision still covers almost 30% of the workplace. I know from my own experience as Joint Secretary of the SLGPS, the largest pension fund in Scotland, that auto-enrolment has also increased coverage, particularly among lower paid, mostly women workers.

While the growth in pension coverage is very welcome, contribution rates are often low. The initial default minimum contribution rates was only 2% of qualifying earnings. More than half of all private sector employees with a workplace pension contributed less than 2%. The minimum contribution is now 5% (with at least 2% from the employer). This will rise to 8% next April (with at least 3% from the employer). it remains to be seen, at a time when real wages are still falling, if these increases result in higher levels of opting out, particularly amongst low paid workers.

The growth in coverage is largely in defined contribution schemes. This type of scheme places the investment risk on the workers who are least able to sustain it. If pension coverage and adequacy is to be sustained we need to defend and grow high quality defined benefit schemes and collective defined contribution schemes that share the risks.

A recent report by MPs on the Work and Pensions Committee highlighted market failure in relation to so called pension freedoms. The committee called for the government to rethink its decision not to allow state-backed provider NEST to offer retirement products. As they say, "Concerns that allowing NEST to offer such products would hinder competition in the market would carry greater weight were there evidence of a functioning market currently."

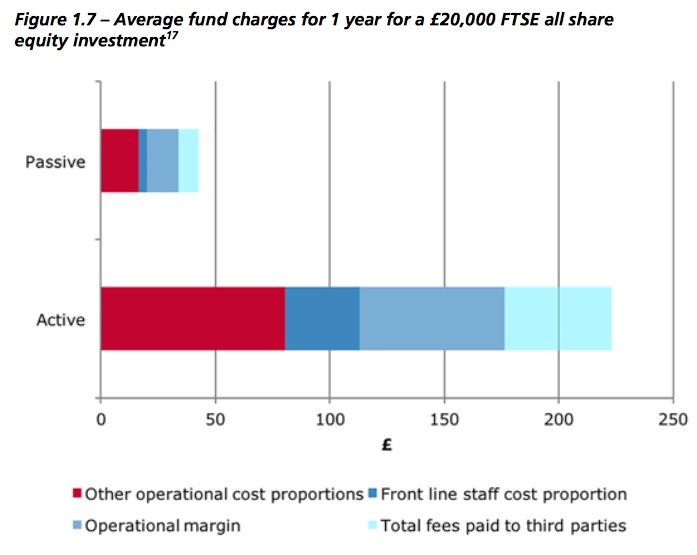

We also need to tackle the lack of transparency over the fees charged by investment managers. This is something UNISON has campaigned on for several years - a cause that has now been taken up by the Financial Conduct Authority. Their study found that fund managers were overcharging clients for hundreds of billions of pounds worth of investments. They enjoy huge profits and salaries, but performance is frequently mediocre. If low paid workers are to be encouraged to hand over their hard earned wages in higher pension contributions, then every possible penny needs to go into their pension pots, not the pockets of fat cats, who are currently ripping them off.

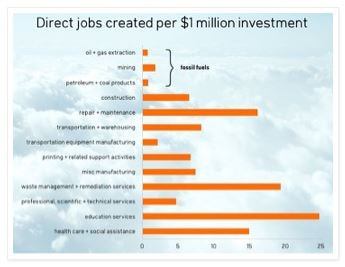

Finally, we also need to ensure that our pension funds are invested wisely and help to grow the real economy and create jobs. For example, investment in fossil fuels is not only risky as the world wakes up to the threat of climate change, but they don't create jobs either as the chart below shows.

So, let's celebrate the increase in pension coverage, but at the same time recognise that we have to put our pensions system in order. We also need to improve real wages and the adequacy of incomes in retirement, if that coverage is to be sustained.

The impact of auto-enrolment on pension coverage has been very significant. As the Resolution Foundation chart below shows, overall workplace pension coverage has jumped from 46.5% in 2012 to 72.9% in 2017.

This chart also shows that the proportion of employees holding defined benefit pensions has continued its longer-term decline. However, this form of quality provision still covers almost 30% of the workplace. I know from my own experience as Joint Secretary of the SLGPS, the largest pension fund in Scotland, that auto-enrolment has also increased coverage, particularly among lower paid, mostly women workers.

While the growth in pension coverage is very welcome, contribution rates are often low. The initial default minimum contribution rates was only 2% of qualifying earnings. More than half of all private sector employees with a workplace pension contributed less than 2%. The minimum contribution is now 5% (with at least 2% from the employer). This will rise to 8% next April (with at least 3% from the employer). it remains to be seen, at a time when real wages are still falling, if these increases result in higher levels of opting out, particularly amongst low paid workers.

The growth in coverage is largely in defined contribution schemes. This type of scheme places the investment risk on the workers who are least able to sustain it. If pension coverage and adequacy is to be sustained we need to defend and grow high quality defined benefit schemes and collective defined contribution schemes that share the risks.

A recent report by MPs on the Work and Pensions Committee highlighted market failure in relation to so called pension freedoms. The committee called for the government to rethink its decision not to allow state-backed provider NEST to offer retirement products. As they say, "Concerns that allowing NEST to offer such products would hinder competition in the market would carry greater weight were there evidence of a functioning market currently."

We also need to tackle the lack of transparency over the fees charged by investment managers. This is something UNISON has campaigned on for several years - a cause that has now been taken up by the Financial Conduct Authority. Their study found that fund managers were overcharging clients for hundreds of billions of pounds worth of investments. They enjoy huge profits and salaries, but performance is frequently mediocre. If low paid workers are to be encouraged to hand over their hard earned wages in higher pension contributions, then every possible penny needs to go into their pension pots, not the pockets of fat cats, who are currently ripping them off.

Finally, we also need to ensure that our pension funds are invested wisely and help to grow the real economy and create jobs. For example, investment in fossil fuels is not only risky as the world wakes up to the threat of climate change, but they don't create jobs either as the chart below shows.

So, let's celebrate the increase in pension coverage, but at the same time recognise that we have to put our pensions system in order. We also need to improve real wages and the adequacy of incomes in retirement, if that coverage is to be sustained.

RSS Feed

RSS Feed