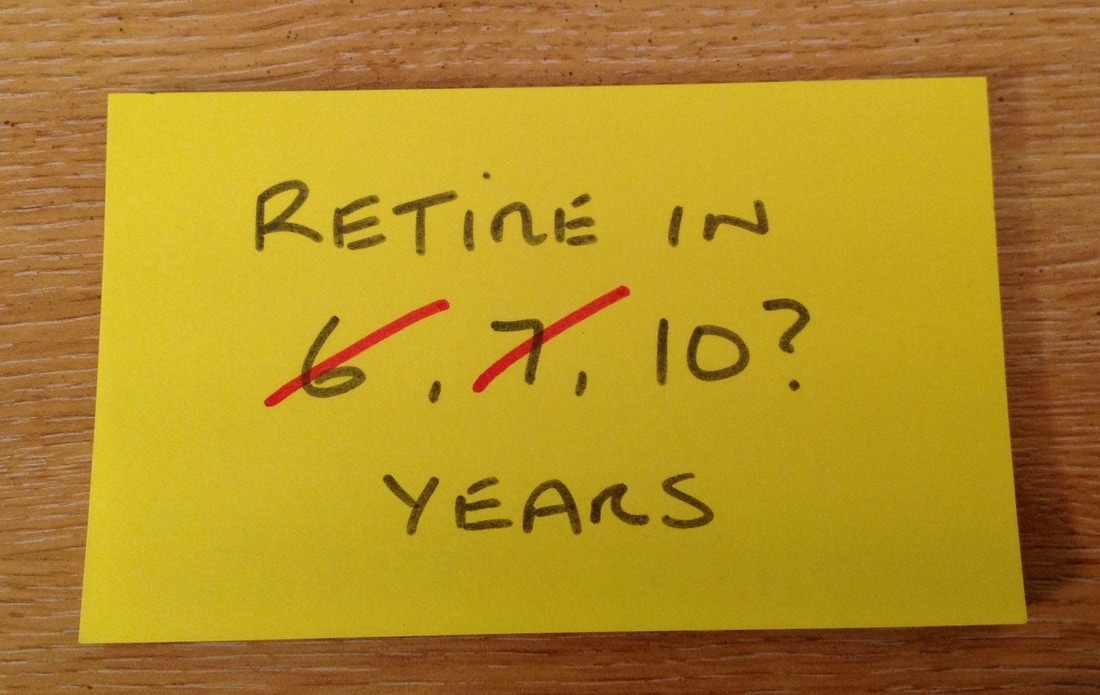

That's the question being addressed by John Cridland's state pension age review, visiting Edinburgh today. They published an interim report last October and are planning to publish their recommendations in March.

They are looking at the period after 2028, which excludes the planned changes before then and the controversy over transitional arrangements, including the issues raised by the WASPI campaign. Although it does highlight the importance of communication and transitional provisions in future.

There are three pillars to the review.

The first is Fairness. As most people probably understand, pensions are no longer paid from the National Insurance Fund - today's pensions are paid for by today's taxpayers. Intergenerational fairness is therefore something the review has to consider.

A key issue in Scotland is that life expectancy is 1.3 years shorter than the rest of the U.K and also worse than most European comparators. This might lead to the conclusion that the state pension age should be lower in Scotland. However, differences in life expectancy within Scotland are much greater than the differential with the rest of the U.K. Social class, income and health remain the main reasons for a shorter life. We also need to recognise the quality of life in retirement.

The second pillar is Affordability. Spending on the state pension is projected to rise from 6.1% of GDP today to 7.2% in 2040s (an extra £20bn at today's prices.). This is largely driven by an ageing and larger population. The relative value is also rising due to the 'Triple Lock', which adds around 0.3% of GDP.

The number of people above the SPA per 1000 workers is also rising. This is called the Dependency Ratio by economists - a very poor and inaccurate descriptor that always irritates me.

We are of course living longer and the review has an interesting slide that shows how every projection since the fifties has underestimated this trend.

The third pillar is Fuller Working Lives. There has been a noticeable trend for people to work longer, even past the SPA. 1.2m people now take their pension and continue working. The reasons for this are not always positive and many are doing different job or working part-time. What gets less coverage is the increasing number retiring early, again not always for positive reasons. Ill health and caring responsibilities - one in nine people now have a family caring role.

Responses to the review consultation have highlighted the role of carers, ill health, burnout, help for older workers and healthy life expectancy. As always plenty of issues for the review to take into account, but fewer solutions.

It's a big issue for public service pensions because the normal retirement age in these schemes is now linked to the state retirement age. As I pointed out today, this means workers in demanding jobs are expected to work well past the age when they can realistically perform their duties.

The answer apparently is that we need to consider changing jobs in the run up to retirement. However, this assumes that such jobs exist and that employers are prepared to fairly consider older workers. John Cridland mentioned B&Q, which is at best is the exception that proves the rule. We spend a lot of time and effort developing younger workers, perhaps we should consider a similar approach for older workers?

In addition, as a recent TUC report shows, barely half of 60-64 year olds are economically active and half a million people within five years of SPA are too ill or disabled to work.

The problem for reviews like this is that their remit encourages silo thinking. Many of the issues identified in the review have little to do with the retirement age. They reflect inequality in the workplace and in society more generally. Raising the retirement age will affect low income workers the most. This is because they have the greatest difficulty in saving for a private pension. High income workers will be able to build up a private pension, which will enable them to take early retirement before the state pension takes effect. The average Scottish local government worker has a pension in payment of just £3,750. This means they might save the taxpayer some social security benefits, but they won't contribute to the higher tax revenues - a common justification for raising the pension age.

Compared to the rest of Europe, the UK has been the most aggressive in raising the SPA. The solution in this review isn't simply to increase the pension age yet again. We need to address a range of broader workforce reforms rather than rely on this crude and unfair mechanism.

here to edit.

RSS Feed

RSS Feed