Welcome to UNISON Scotland's pensions web site.

This is where you will find the latest news on pensions in Scotland; essential information about the pension schemes UNISON members belong to; UNISON Scotland publications and links to other useful sources of information.

This is where you will find the latest news on pensions in Scotland; essential information about the pension schemes UNISON members belong to; UNISON Scotland publications and links to other useful sources of information.

|

Privacy Policy

You can view our privacy policy here |

LATEST NEWS

Life Expectancy stalls

After decades of steady improvements in life expectancy, the most recent figures have shown no change in life expectancy across the UK. In Scotland, it has fallen for the first time in 35 years. The decreases in Scotland were recorded for people born between 2014-2016 and 2015-2017. Complaints process changes

The merger of the Pensions Advisory Service (TPAS) with Pension Wise and The Money Advice Service to form a new Single Financial Guidance Body has been delayed due to the Brexit legislative logjam. However this is still expected "at the latest by April 2020". Despite the changes not formally being in place the DWP are advising that all complaints are referred to the Pension Ombudsman with general requests for information and guidance going to TPAS. 1-1 supervision by Regulator

The Pensions Regulator (TPR) is introducing one-to-one supervision for the 25 biggest DB and public service pension schemes from October 2018, and will be rolled out to more than 60 schemes over the next year. The approach will be based on four key areas:

Fee Transparency "like Hillsborough"

The chair of the Work and Pensions Committee has compared the lack of fee transparency to “the Hillsborough cover-up”. The Financial Conduct Authority's (FCA) Institutional Disclosure Working Group former chairman Dr Chris Sier highlighted key reasons for a lack of transparency as a “’we've never done it before’ attitude, a lack of demand for cost data and poor delivery of such data, compounded by the overall complexity of the ‘operationally inefficient’ industry”. New cost disclosure templates for asset managers will be published by the FCA this autumn. Concern on Transfer Payments

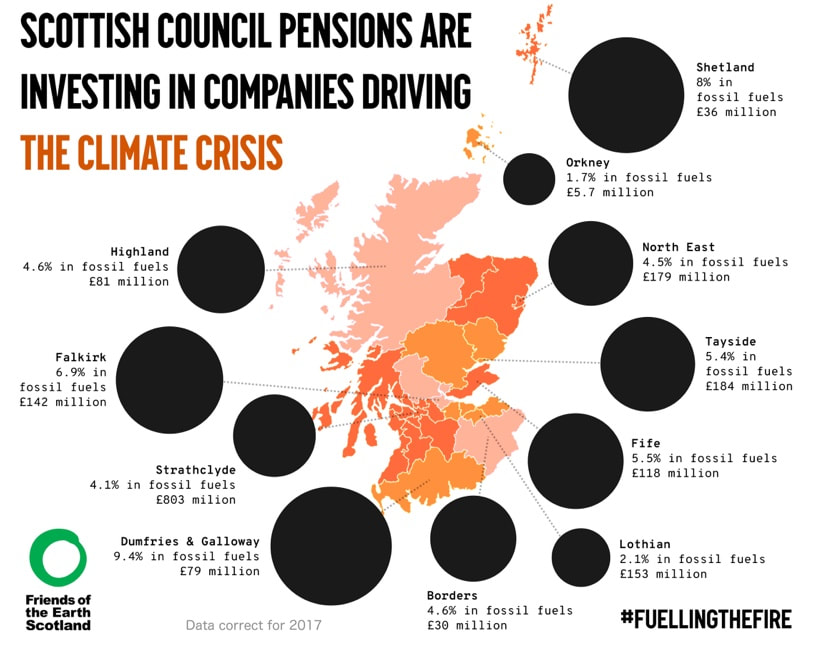

The Pensions Regulator has written to 12 Defined-Benefit pension schemes warning that overly generous transfer payments to savers leaving the schemes could pose risks to those remaining in the scheme, and also to those withdrawing money. The British Steel scandal highlighted some of the risks to individuals. Climate Change investment risks

Climate change rules already apply to public bodies, but from 1 October 2019 Defined Contribution schemes will be required to produce a statement of investment principles (SIP) showing how they consider environmental, social, governance and similar risks in investments. From 2020 they will have report on implementing this. Pensions Dashboard

The pensions dashboard, aiming to bring together all pensions information for individuals, has been given a lifeline by the government after 175,000 people signed an online petition. The UK government is supporting an industry-led dashboard but has not agreed to include state pension data, or require pension providers to supply information in a standard format. The hurdles to its introduction may still look significant. Collective Defined Contribution

The government will launch a formal consultation on new Collective Defined Contribution (CDC) schemes in the autumn. Scottish Pensions Bulletin

The latest edition of UNISON Scotland's Pension Bulletin is out now. Legal threat to pension funds over climate change

The UK’s biggest pension funds have been warned by lawyers they risk legal action if they fail to consider the effects of climate change on their portfolios. ClientEarth, the legal environmental campaign group that sued the UK government over air pollution, is urging them to consider how they manage and report on climate risk. In Scotland, councils have a statutory duty to do so. More examples of poor investment choices

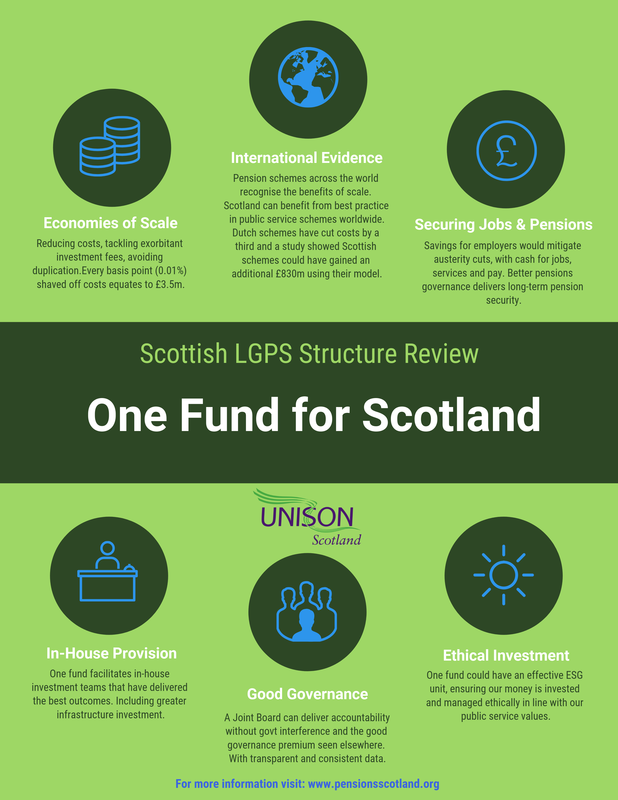

More than £1.7bn has been directly invested in tobacco company stocks by healthcare providers, fire authorities and schools via UK council pension funds. The 'top' ten sadly includes Scottish funds, Lothian and Tayside. The Sunday Post has also highlighted at least £138 million investment in firms backing President Trump's immigration detention centres. Fee transparency cuts costs

Schemes in the Netherlands saw investment costs fall by more than a third in just one year under its compulsory cost reporting framework. This strengthens the case for the LGPS and FCA work on a similar framework for the UK. A point being pursued by the Department for Work and Pensions Select Committee inquiry, which focuses on whether the pensions industry provides sufficient transparency around charges, investment strategy and performance to scheme members. Pensions robbery

Pension scam victims lose an average of £91,000 each as fraudsters see the potential for looting savings pots. Sadly, this was just what UNISON and others predicted would happen with pension 'freedoms'. Unscrupulous employers are also robbing their staff. The number of complaints received by the pensions watchdog accusing employers of attempting to get staff to opt out of saving for retirement increased by 68% last year. And finally, the coalition of employers, politicians, actuaries and regulators who have robbed workers of Defined Benefit schemes, putting the burden of pension risk on those least able to bear them. Child benefit and state pension entitlement

Half a million women opted out of receiving child benefit and many more never applied in the first place. Why? Almost certainly because their partner was earning more than £60,000 a year, which is the final cut-off point for the payment. This may save some admin, but they are denying themselves a full state pension. How the National Insurance Fund was robbed

Revealed: how £271bn was not put into the fund as intended. The cash that could have paid the WASPI women their state pension without raising the retirement age. MPs support new collective pensions

A cross-party committee of MPs has become the latest group to urge the government to move quickly to allow a new breed of collective pension schemes to be set up in the UK. They could provide a really useful “middle ground” option between the types of workplace pension currently available. Royal Mail have done something similar. No thanks to reheated annuity sale plans

Helping savers get a good deal in retirement is a laudable aim, but reviving flawed plans for a secondary annuity market is not the answer. Here is why the Daily Mail campaign is flawed. Why we need radical pension reform

UNISON's Dave Watson sets out the case for a radical reform of our pensions system in The Scotsman newspaper. UNISON response to investment regulations consultation

Government consultation on clarifying and strengthening trustees’ investment duties to open up consultation with scheme members on what happens with our members money in private sector schemes once invested. Time for a rethink on the state pension age?

The great leap forward in longevity has come to a shuddering halt. An extraordinary analysis by the Office for National Statistics reveals that the trend line in longevity stopped in 2010, and has flatlined since. As Patrick Collinson argues in the Guardian, its time for a rethink. Workers need greater pension protection

The UK government has published a feeble 'wait and see' response to the Work and Pensions Committee report on pension freedoms. TUC General Secretary Frances O’Grady said, “Workers need security in retirement. But millions of savers risk buying rip-off products, falling victim to scams or running out of money in old age. Telling savers to shop around is not good enough. All pension schemes should give savers access to good value default options at retirement. This must include state-backed NEST.” Adding insult to injury the UK government is planning to dump the pensions dashboard. Green light for pension funds to dump fossil fuels

Managers of the £1.5tn invested in Britain’s workplace pension schemes are to be given new powers to dump shares in oil, gas and coal companies in favour of long-term investment in green and “social impact” opportunities. Pension funds invested in tax dodging PFI schemes

Scottish local government pension funds are being invested in tax dodging PFI schemes, a joint Ferret/Guardian investigation shows. UNISON's Dave Watson described the pension fund investments as “simply wrong”. Backing offshore firms means that “billions of pounds of revenue are lost every year that could have been invested in vital public services”. Scottish Pensions Bulletin

The latest Scottish Pensions Bulletin out now. SLGPS structure review, NHS pension contributions, fossil fuel divestment and much more. SLGPS Scheme Advisory Board Bulletin

Latest edition can be viewed here. Covering the May meeting of the Board. Support for fossil fuel divestment grows

The divestment campaign is growing with international support. An international coalition of Catholic institutions, including SCIAF in Scotland, have pledged to take their money out of fossil fuels. The commitment by 35 religious orders, lay organisations and social justice movements to "divest" their money from the polluting energy sources was announced by the Global Catholic Climate Movement (GCCM). The University of Edinburgh will also divest from fossil fuels completely within the next three years as part of its plans to become carbon neutral. Pensions coverage

Our latest blog explains why improved pensions coverage wont be sustained unless we reform the pensions system. SLGPS Annual Report

The Scottish Local Government Pension Scheme Advisory Board has published its annual report. The scheme is in good shape, but with some big challenges ahead. Public service pension increase

Public service pensions will increase by 3% for pensions paid before April 2017. The increase is effective from 9 April 2018. For contributing members, pension pots under the CARE schemes will also increase by 3% for service in the current financial year. SLGPS Contribution Rates

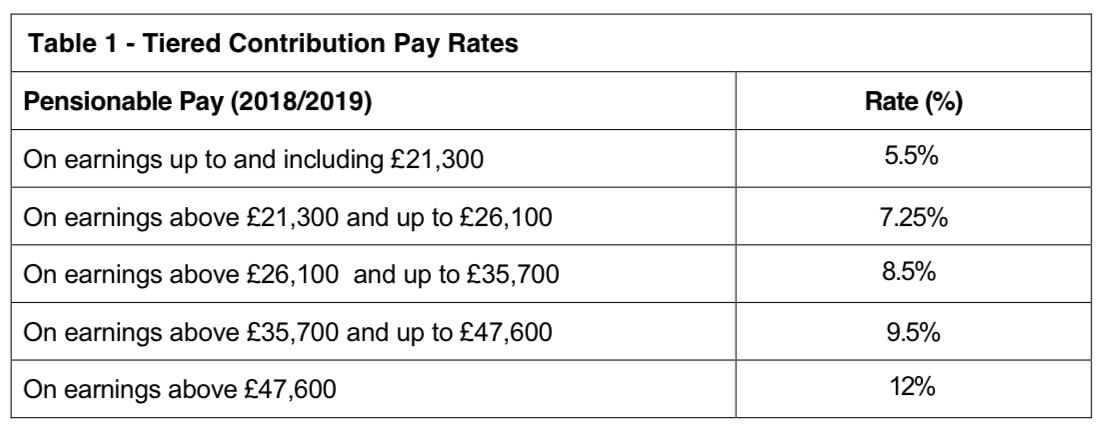

The SPPA has published new guidance on how contribution rates should be calculated in the Scottish Local Government Pension Scheme. It has also increased the bands as follows:

9 steps to better pensions

TUC Pensions Officer Tim Sharp sets out nine steps to improve pensions in the UK. An analysis by the Resolution Foundation offers upbeat forecast of retirement prospects of young adults, though news for men in 40s is grim Bus firm is first employer guilty of failing to auto-enrol

A bus operator has become the first employer in the UK to be found guilty of failing to auto-enrol its staff on to a workplace pension scheme – as experts warned that even businesses making minimum contributions could be leaving themselves open to future legal action. State Pension Age rising again

The UK govt has just sneaked out before the recess, the news that the SPA and therefore all public sector pension schemes will increase to 68. This is despite recent evidence that life expectancy is slowing up. The low paid, who die early, are paying for austerity again. Equal pensions for same sex partners

The Supreme Court has decided that pension schemes may be obliged to provide pensions to civil partners and same sex spouses based on the member’s full period of pensionable service. Useful briefing here.

Pensions Regulation issues guidance on investment strategies

As part of its strategy to produce simpler guidance for occupational pension schemes, The Pensions Regulator (TPR) has published new investment guidance for trustees. Pay attention to your pension

UNISON Scotland's Dave Watson writing in The Scotsman explains why we should pay more attention to our pensions. Green Paper on Defined Benefit pension schemes

The UK government has published a Green Paper on the future of Defined Benefit schemes. While its fairly vague, it doesn't join the rush to write off these schemes. The TUC's Tim Sharp gives us a helpful overview at the Touchstone blog.

Age discrimination legal ruling

An Employment Tribunal has ruled transitional protections in the judiciary pension scheme breach age discrimination laws. This decision could have far-reaching consequences across other public service pension schemes where similar transitional provisions were adopted. There is a useful briefing from Eversheds here. GMP Equalisation

HM Treasury has issued a consultation paper on proposals to provide equal and fully inflation-proofed guaranteed minimum pension (GMP) entitlements for male and female members of public service pension schemes. The options could add between £1.5-£5bn (0.15-0.5%) to the combined liabilities of public sector schemes. The cheaper options add huge additional administration requirements on schemes. Recovering Pension Overpayments

Useful Eversheds Briefing on the Webber v Department of Education legal case on how far back pension schemes can recover overpayments. Pensions Regulator warns on ESG issues

For those who think environmental and social issues don't matter in pensions, the regulator's executive director has recently highlighted their guidance on ESG; "With regards to ESG our guidance is clear that we expect trustees to take ESG issues into account when assessing portfolios over the long term," he said. "It is also worth noting that if the revised Institutions for Occupational Retirement Provision directive (IORP II) comes into effect then it will be a legal requirement that trustees take these issues into account. I would urge any trustee or asset manager out there who still thinks these things don't matter to wake up and smell the coffee. We need to guard against complacency here." On this issue, Scottish universities are the latest to come under fire for unethical investments . |

LINKS

|